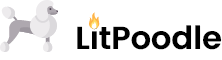

Home Page

If you know which areas to look for, use our search box. If not, take a look at our Recommended Properties section to see algorithm selected properties.

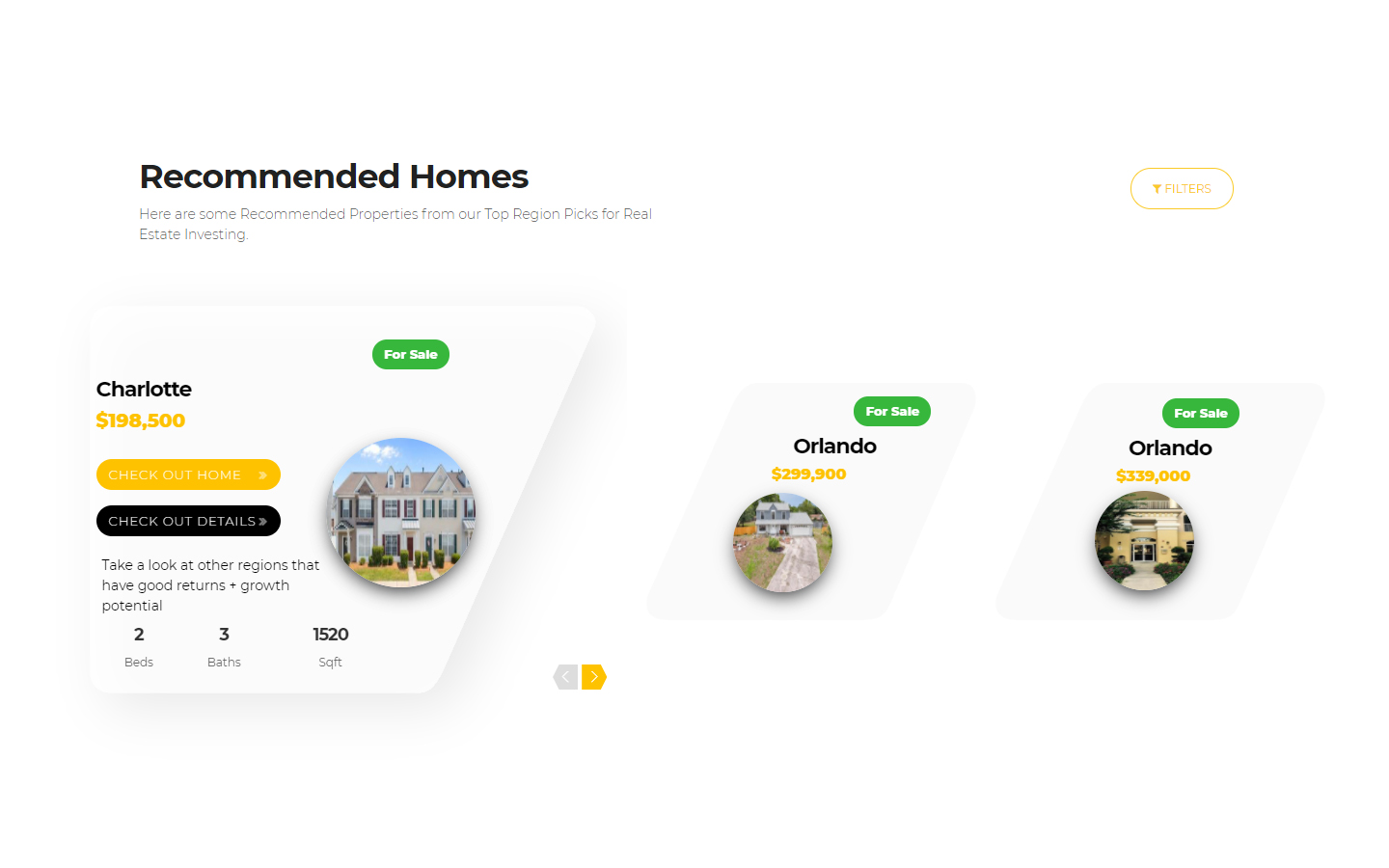

Single Details Page

After signing up, click on any property to see our revolutionary metrics. You can even compare the estimated performance with other homes and stocks. And many other exciting details !!!

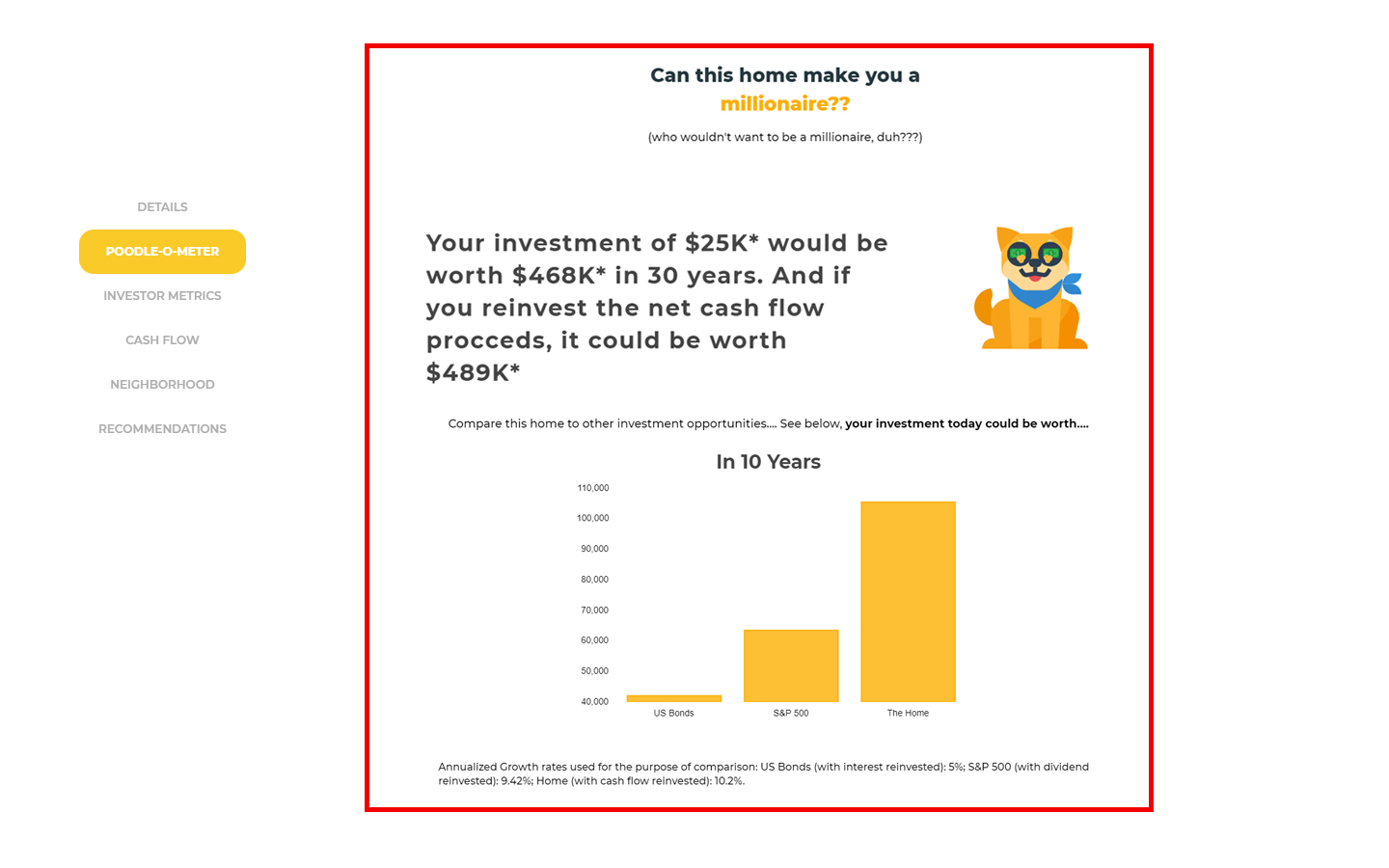

Single Details Page

All the details shown for a home are based on a set of estimations (e.g. rent) and assumptions (e.g. interest rate). All these are listed under 'Set Parameters' and are customizable! Tweak and Play to get a better idea!

Single Details Page

For every home, we crunch all the numbers for you (like rental yield, ROI, neighborhood parameters, etc.) and give you our verdict on whether it is worthy of your time!

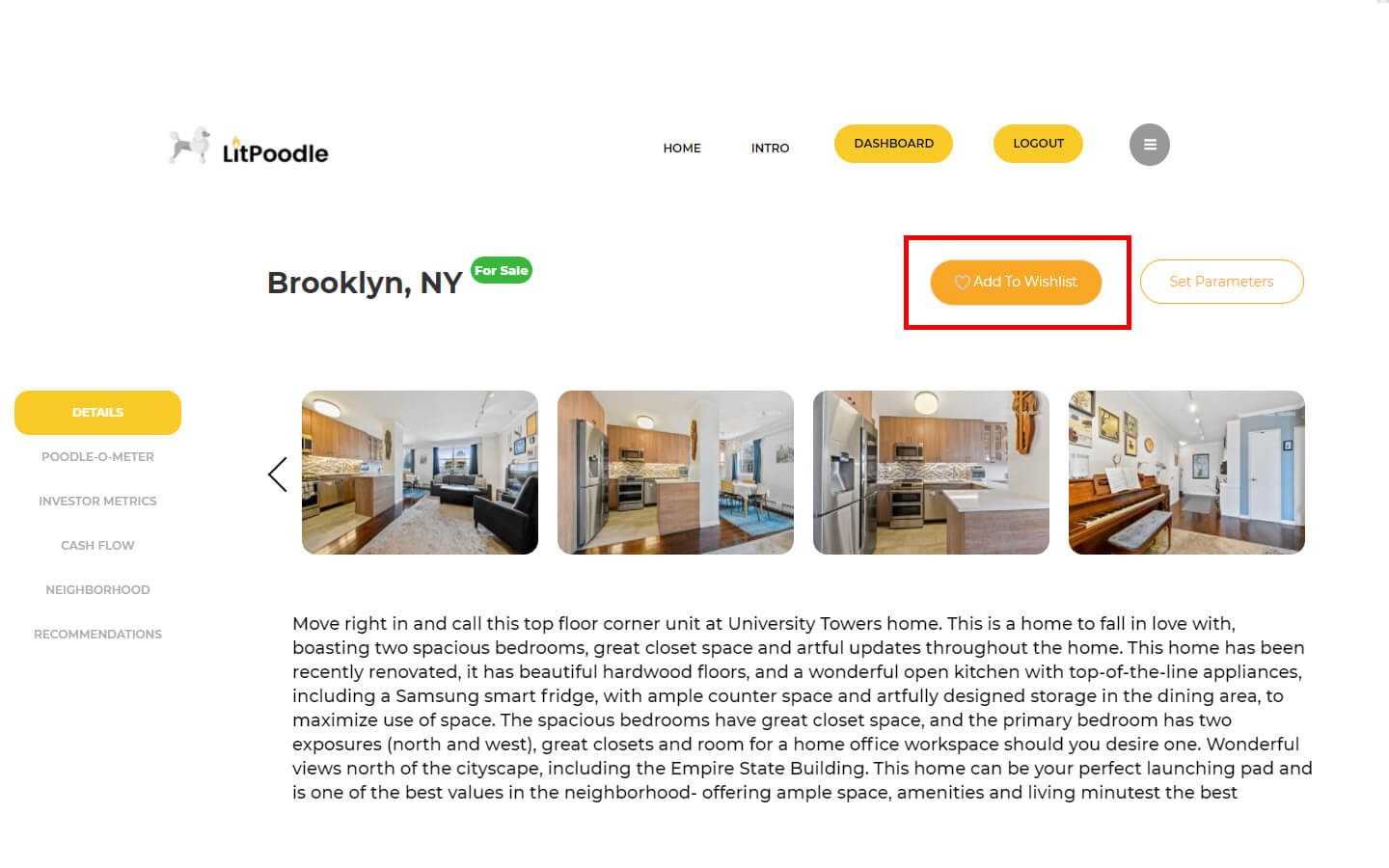

Single Details Page

Click on 'Add to Wishlist' to shortlist any property you like.

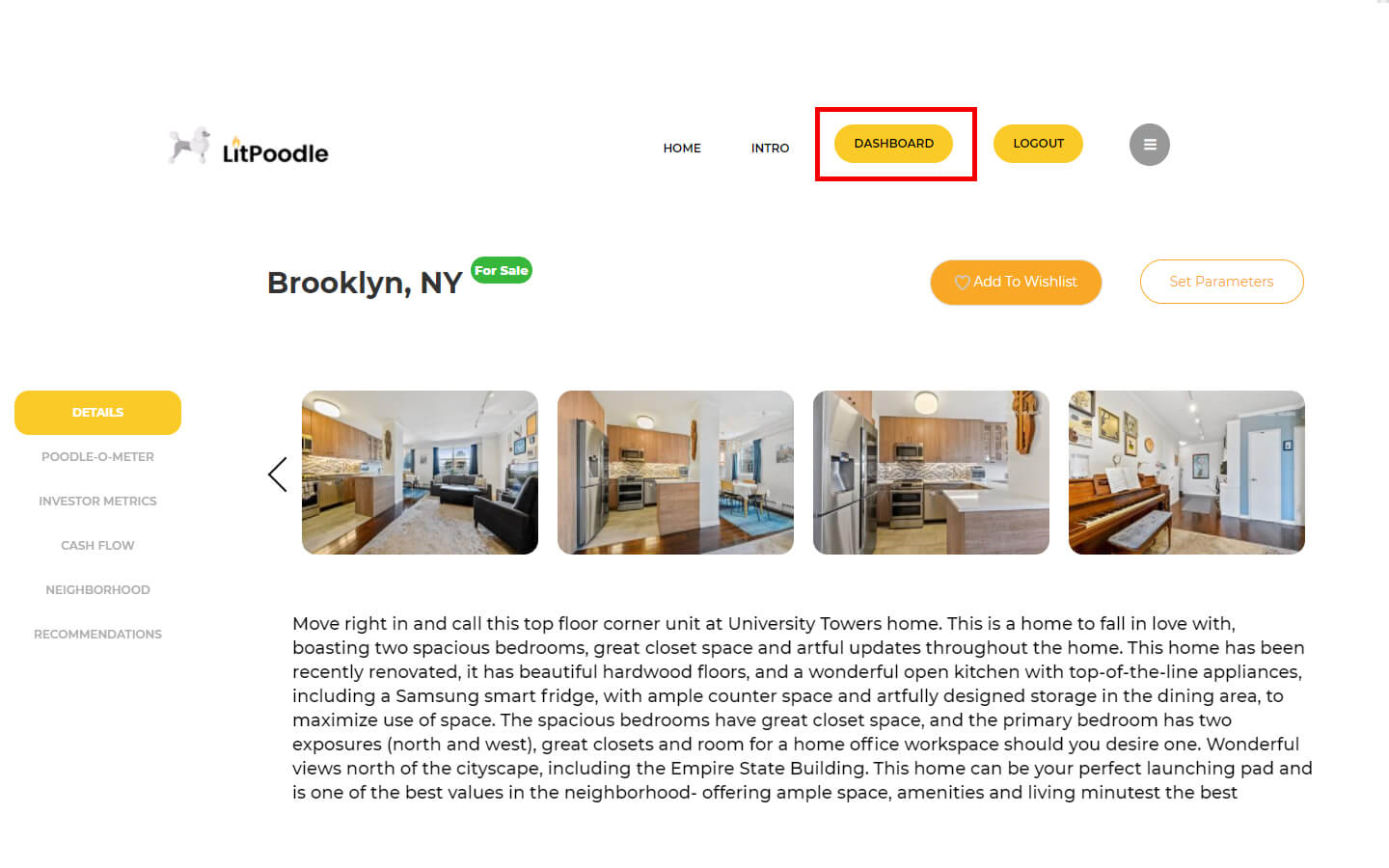

Single Details Page

You can find the list of all shortlisted properties by visiting your 'Dashboard'.

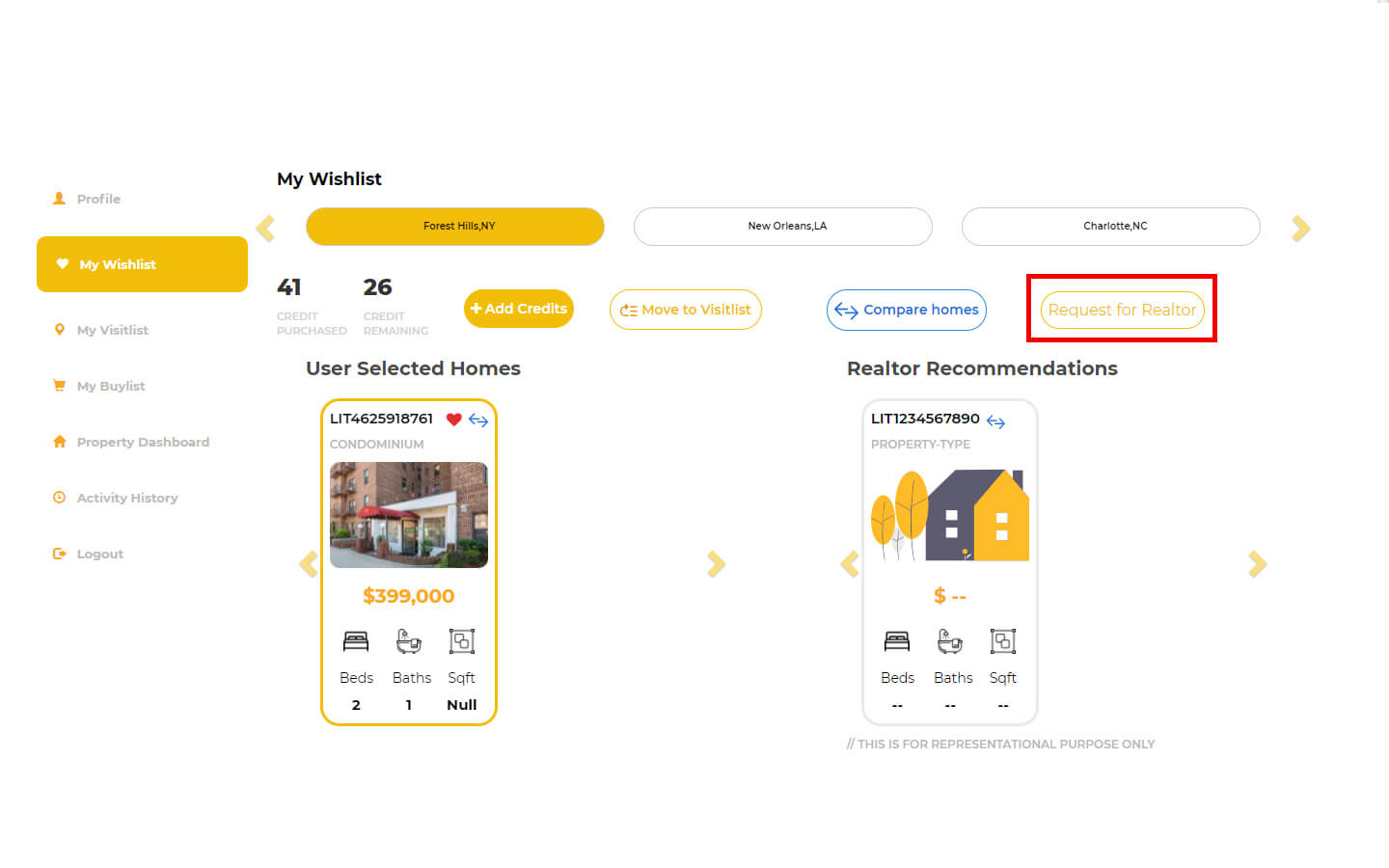

User Dashboard > My Wishlist

Once you are ready, click on 'Request a Realtor' to select and to be matched with a local realtor.

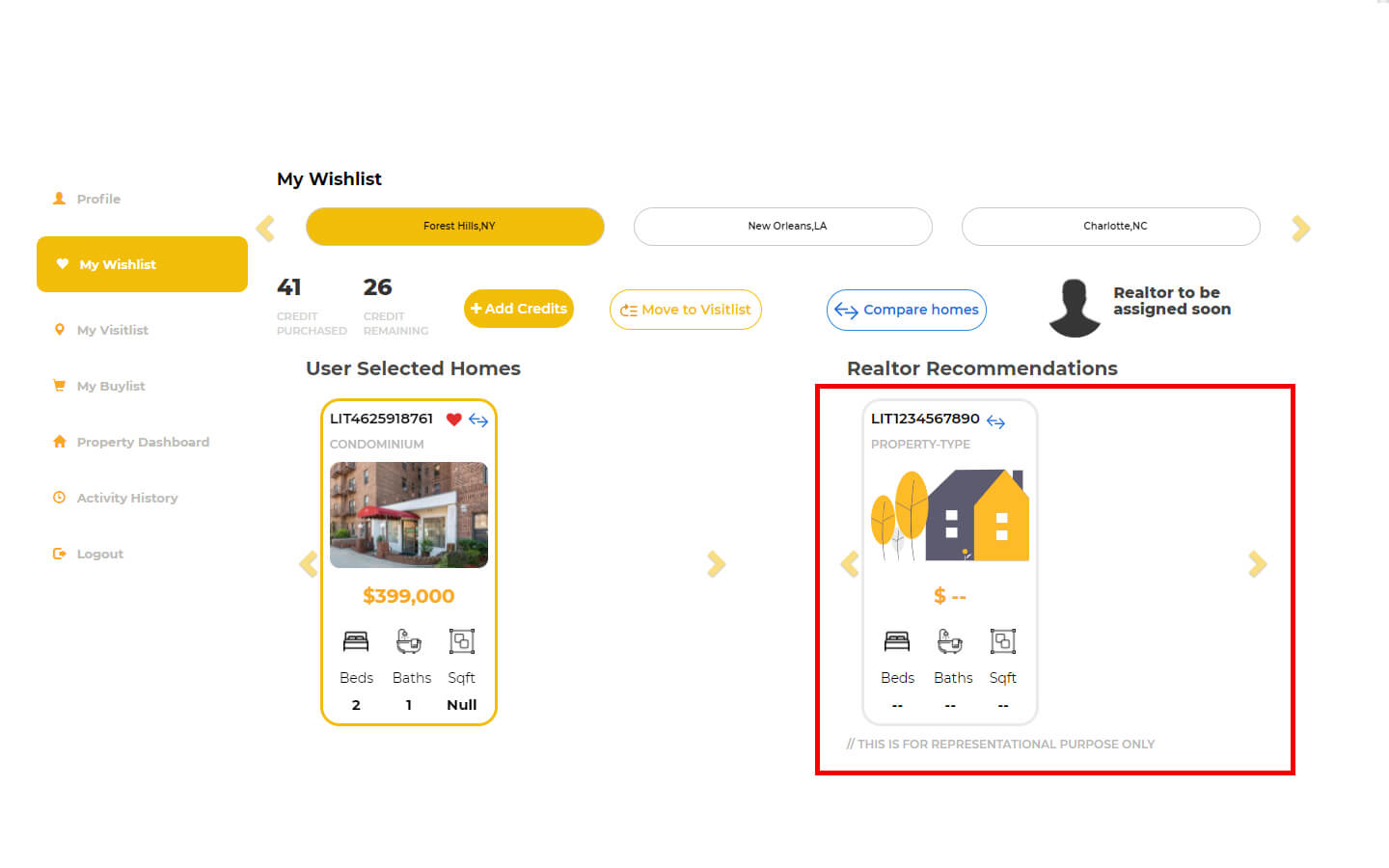

User Dashboard > My Wishlist

The Realtor might send some properties for your perusal. You can find them here in this box.

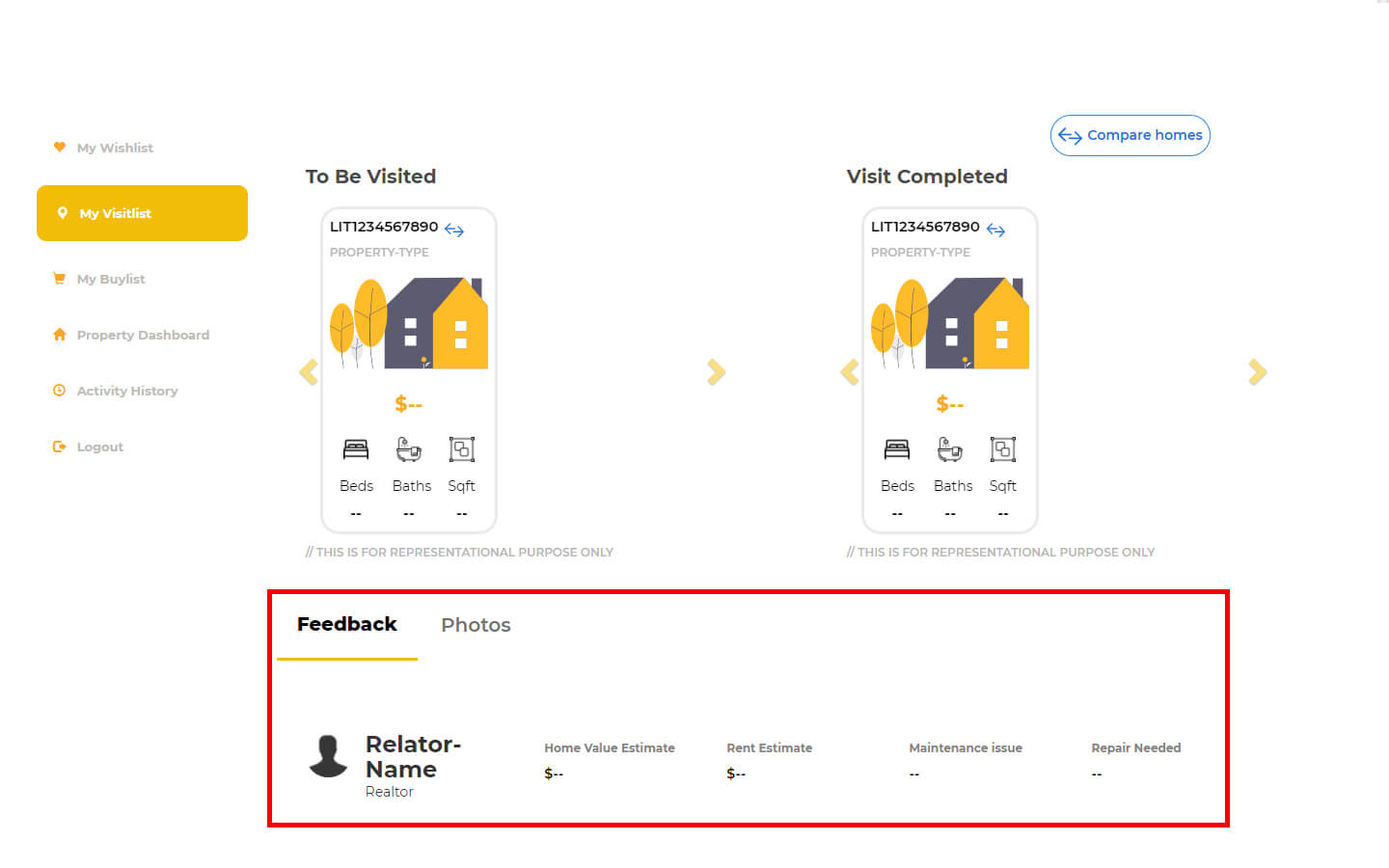

User Dashboard > My Visitlist

You can request your realtor to visit the property and provide Feedback. Use this section to keep track of the feedback for every property.

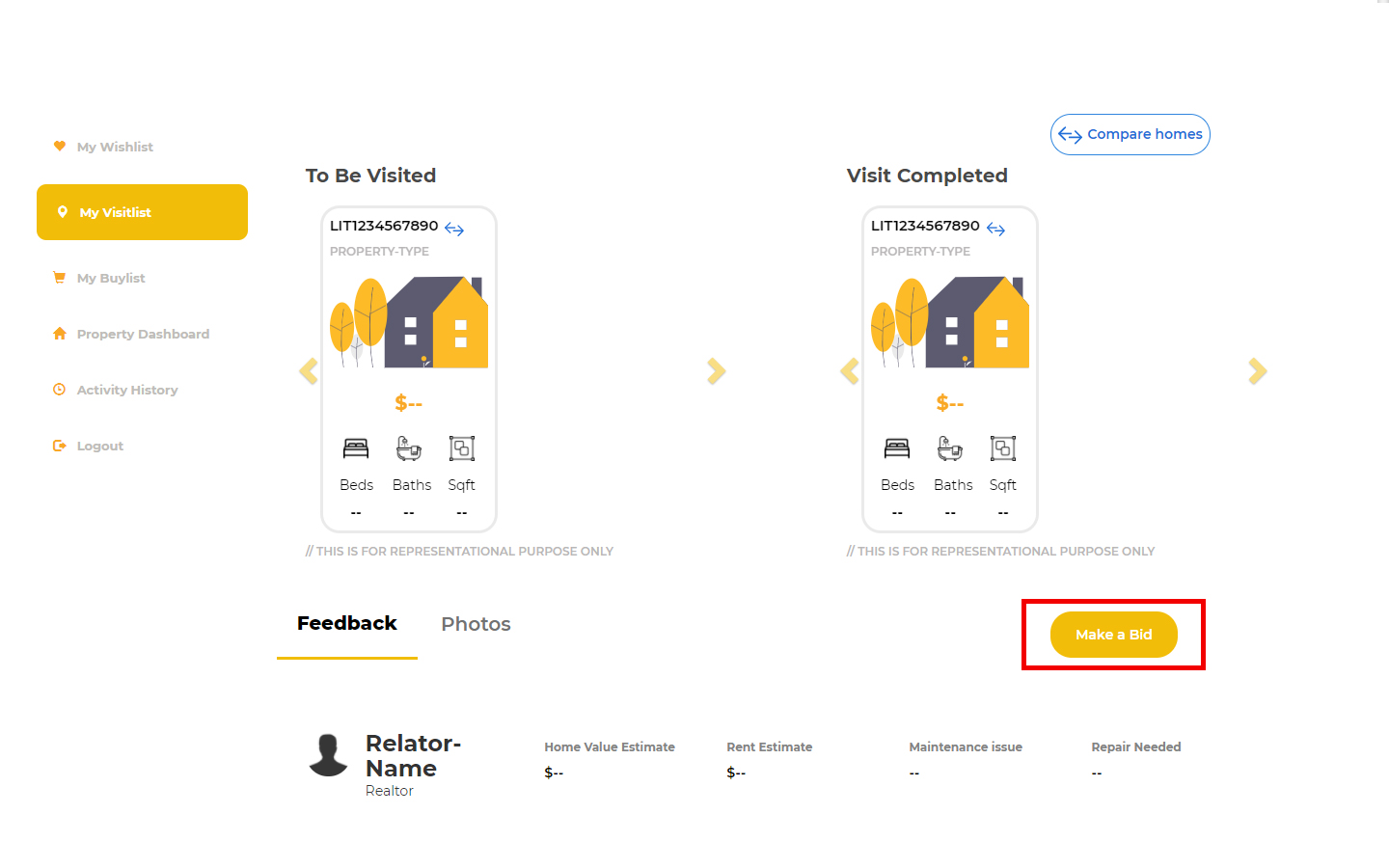

User Dashboard > My Visitlist

If you like a property, click on 'Make a Bid' to proceed to the next step.

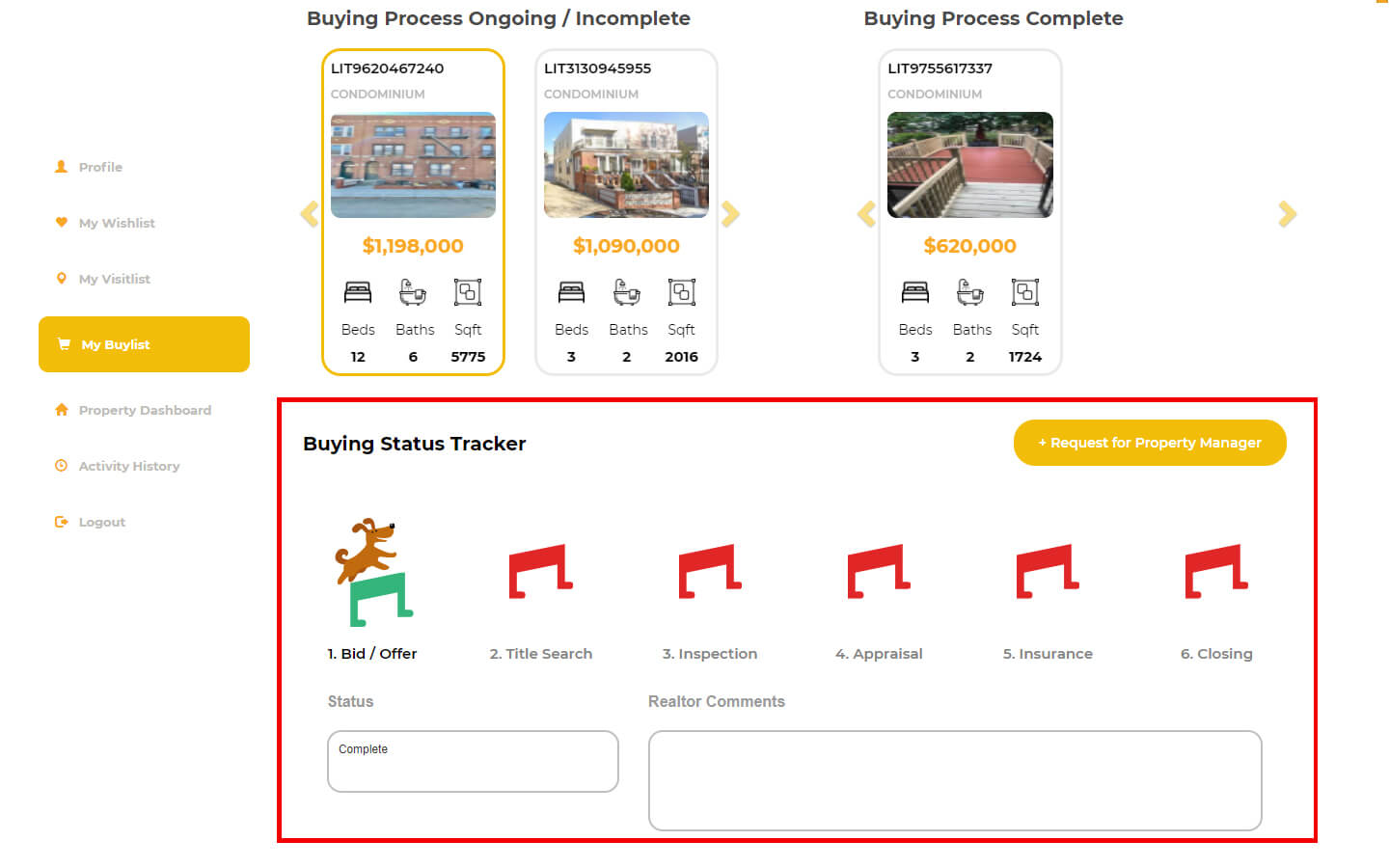

User Dashboard > My Buylist

Once you make a bid, keep track of the buying process through our specially created tracker

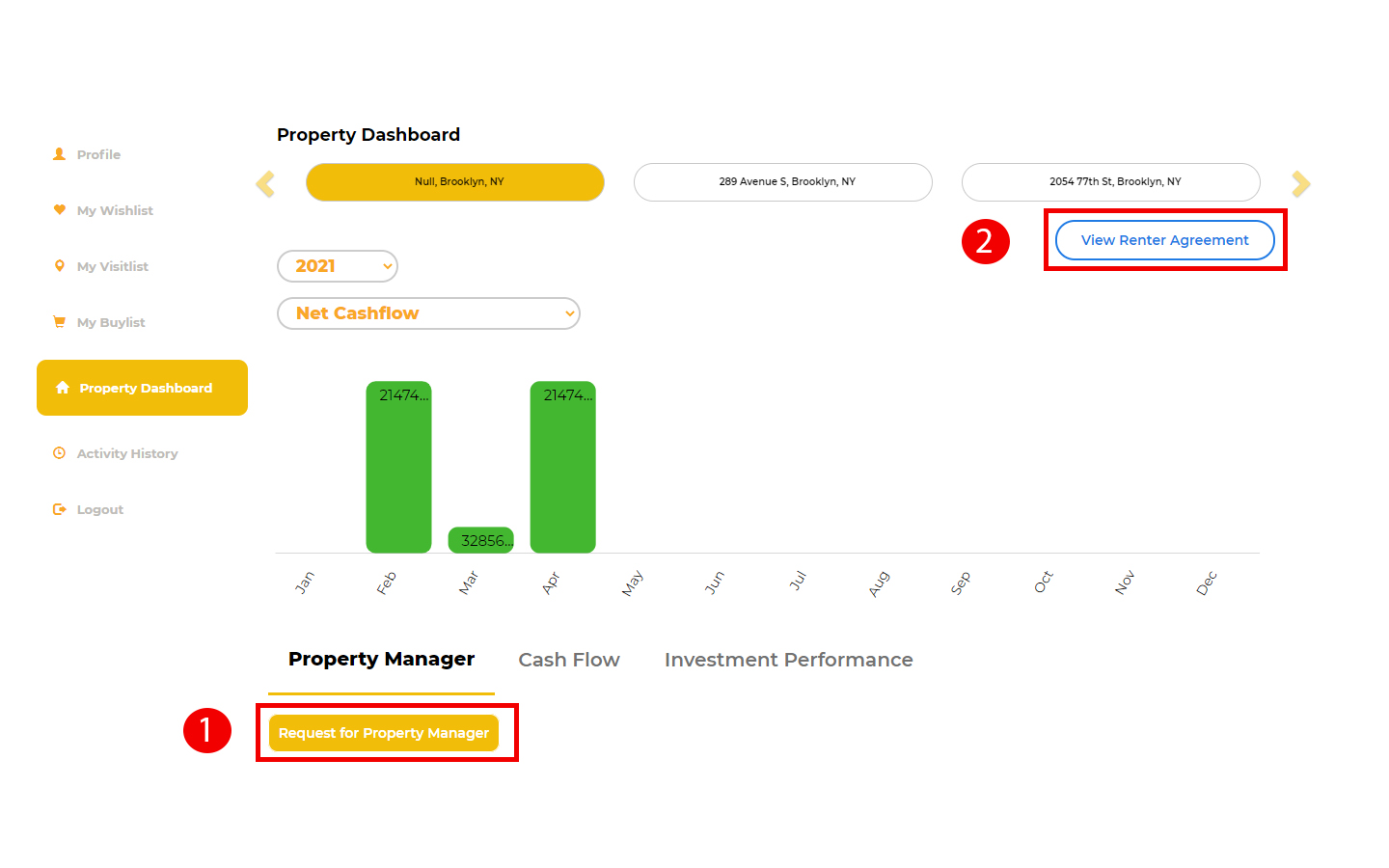

User Dashboard > Property Dahboard

Step 1 : Click here' to see the list of Property Managers in your property's locality.

If you choose to self manage, use our dashboard to keep track !!

Step 2 : Click here to upload and view Renter Agreements.

User Dashboard > Property Dahboard

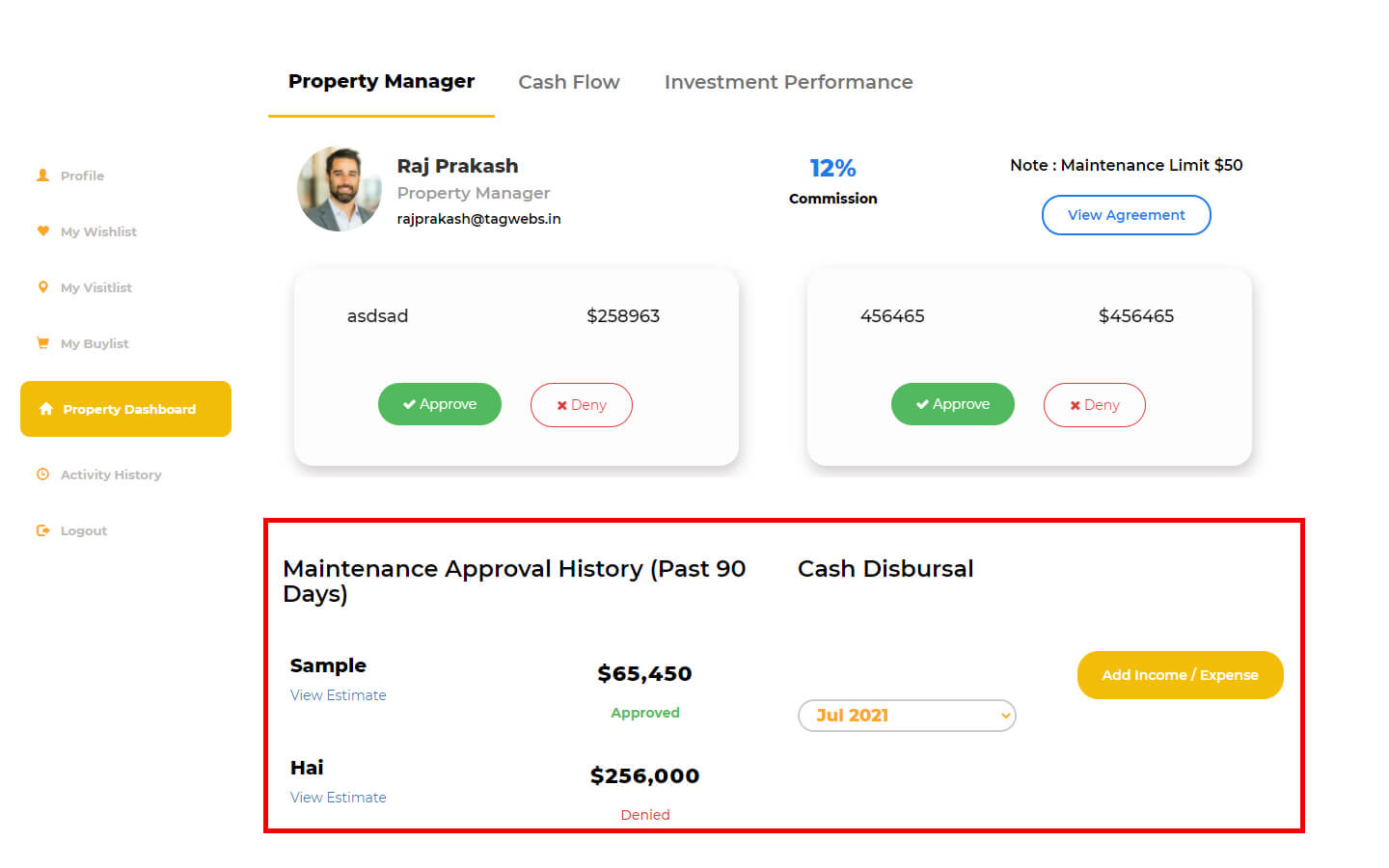

If you have requested a Property Manager, you can use this section to approve or deny repairs.

User Dashboard > Property Dahboard

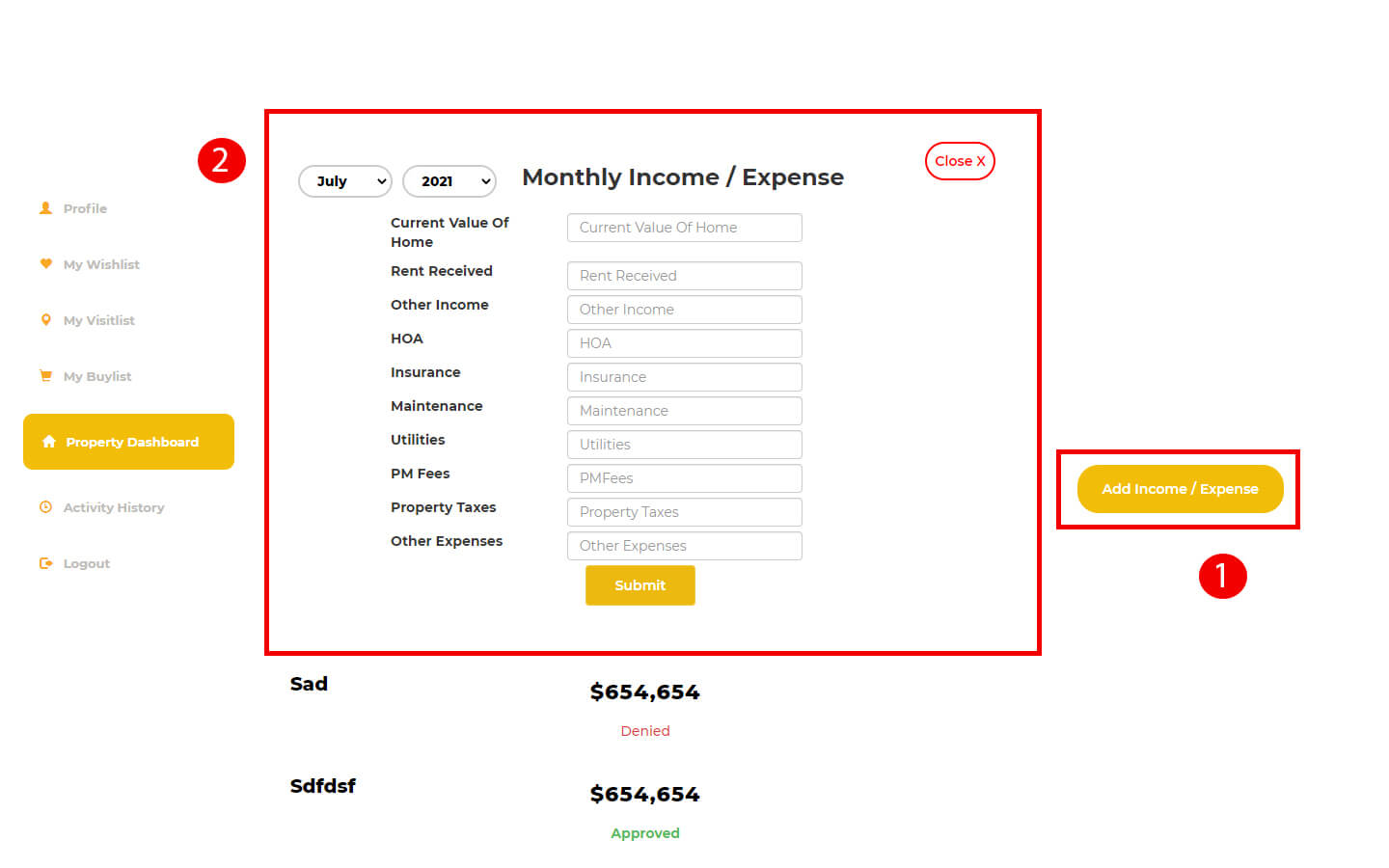

Step 1 : Click 'Add Income/Expenses' under either of 'Cash Flow' or 'Property Manager' tabs.

Step 2 : Choose Month and Year at the top of this box and enter the corresponding month's income & expenses.

User Dashboard > Property Dahboard

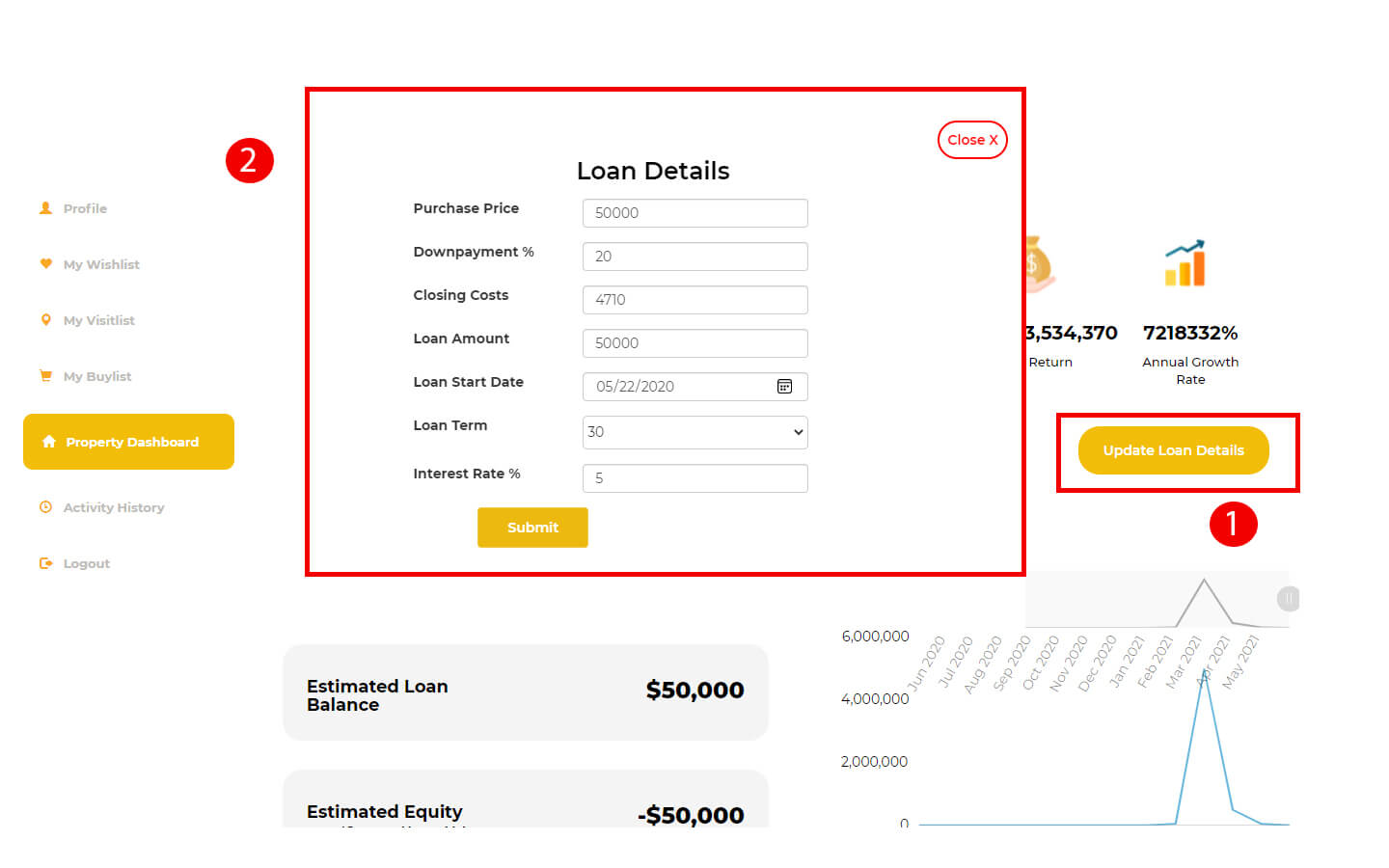

Step 1 : Under 'Investment Performance' tab, you can see your property's financial performance.

Step 2 : Click on 'Update Loan Details' to enter and to let the system automatically calculate monthly mortgage payments and other metrics.

LitPoodle provides an end-to-end hassle-free solution for residential real estate investing. This includes identifying & recommending good investment opportunities, estimating & calculating investor metrics (example: % return, rental yield, etc.), helping with the buying process, assisting with the property management and finally tracking the investment’s performance.

LitPoodle’s mission is to democratize the real estate investing process and alleviate the stress points so that more people get on this wealth ladder. Real estate is one of the primary mechanisms for building wealth and unfortunately there is a sizable section of our society that is missing out due to the lack of awareness. LitPoodle aims to address this gap by educating people on the opportunities and offering unique insights, providing transparency and making the investing process as simple and efficient as possible.

LitPoodle’s technology is a key differentiator. Here a few ways where our technology stands out :

Also, LitPoodle is a one-stop solution for residential real estate investing that makes investing as simple as 1-2-3.

LitPoodle is neither a crowdsourced fund nor a REIT. You, as an investor, will be owning the investment properties. We will help facilitate the investing and managing process. We believe that buying carefully selected individual investment properties yield better returns for the investor than investing in REITS or funds since the law of diminishing returns holds true for real estate investing as well.

LitPoodle is not a brokerage. It is an online real estate investment portal where you can search for properties, find recommendations, peruse the investment metrics, get linked to licensed agents for purchasing property, keep track of the purchasing process, get assistance with management of property and finally track the investment performance.

LitPoodle, however, will you refer you to a licensed real estate brokerage for the actual purchase of property.

Yes, LitPoodle will refer you to a licensed real estate brokerage to help you in the purchase of property. So you will have the benefit of buying a property through a regulated process.

And yes, your purchase of the property will be handled by licensed real estate agents. Your interests will be protected by a licensed agent representing you.

If you are not satisfied with the performance of your assigned brokerage, agent or property manager and would like to request for a change, please contact [email protected]. We also would love to hear your feedback and suggestions, if any, at [email protected]

Currently, all listings on LitPoodle are sourced from MLS. MLS is one of the most trusted and reputed listing services available in the USA. To find more details on MLS, click here.

At the moment, LitPoodle does not have the ability to directly list properties from the seller. But if you do have a property that you want to list either on MLS or other listing aggregators, we can refer you to a licensed agent who can help you. For more information, please contact [email protected].

At LitPoodle, we believe transparency is paramount. We are continuously developing our products and improving our technology to provide much more transparency than what is available through conventional processes (like for example, providing status updates through a tracker once the property is under contract).

Also,

Currently, we are able to service investors from and also find properties in all 50 states and D.C.

Remote buying refers to investors investing in properties outside the areas they reside or frequent. Remote buying is becoming more and more popular as investors try to take advantage of the better returns on investment offered by fast growing markets that might be outside their sphere of influence.

Yes, you can and we encourage you to participate in remote buying. At LitPoodle one of our objectives is to make remote buying as easy, simple and secure as possible.

Once you have identified an area to invest in and we have matched you with a local licensed agent, you are more than welcome to join the agent to visit the shortlisted properties.

You will be owning the property. You will be holding the title to your property. After purchase, you can either decide to manage the property by yourself or to hand it over to a property manager for management. If you decide on the latter, we will help you find a property manager.

Real estate investing has a plethora of benefits. And depending on your preference, you can invest in real estate to build your wealth through capital appreciation, supplement your income with rental returns, diversify your asset portfolio and/or protect your wealth by investing in stable markets.

For more information on benefits and how to get started, refer to our Blog and Home page.

You can reach LitPoodle by emailing [email protected]

By default, our calculators try to incorporate real world scenarios (for example, the model assumes that the property will be mortgaged with 20% downpayment). You can change these assumptions by clicking on ‘Set Parameters’, if you wish. Following are brief explanations provided for some of the metrics.

For more information, please refer to our Blog.

Rental Estimates for a property that you see on the property details are system generated. We have undertaken best efforts to give the closest estimates of rental values. However, we cannot guarantee 100% accuracy due to a myriad of factors. After you pay the fee and are matched with a licensed agent, the agent will be able to verify or update the estimate if necessary.

With respect to other calculations, there are several assumptions underlying the model. We have tried to estimate those assumptions conservatively. For example, the annual home price increase is conservatively assumed to match the inflation rate, although it can be much higher.

You are also more than welcome to edit the rental estimates and the assumptions under ‘Set Parameters’ tab.

‘Set Parameters’ tab is available in the property details. All the estimates and assumptions that underlie the mathematical models are listed in this tab. In this section, you can vary estimates such as rental estimates or assumptions such as annual home price increase or annual rent increase or closing costs.

You can also set your investment comparables here. If you want to compare the selected property to other investment opportunities such as stocks, bonds or ETFs, you can enter the name of the opportunity and its expected growth rate. The system will then provide you with a comparison on the property details page.

The model, by default, assumes that the property will be mortgaged with 20% down payment. If you are planning to purchase it all in cash, enter ‘100’ under Downpayment in the ‘Set Parameters’ tab.

After purchase, you can either choose to manage the property by yourself or by hiring a property manager. If you decide the latter, we will help you find one. You will need to click on the ‘Request a PM’ in the ‘Purchased Homes’ dashboard section of ‘User Profile’.

Regardless of whether you request for a property manager or not, you will get access to our property management dashboard under ‘Purchased Homes’. Here you can

Doing so, you can track your investment’s performance using metrics like net cash flow (for any selected period), growth rate, etc. and see how the metrics are trending over time too.

The service fee is for matching you with a licensed agent in a particular region that you are looking to invest. Each distinct region will entail a separate fee payment.

We don't store any of your credit card or debit card information on our site. The payment is handled through a secure external vendor such as Stripe.

You can request your assigned agent for the address once you have paid the service fee and been matched with a licensed agent.